Trusted Vision AI

We build Vision AI that is globally trusted to solve some of the world’s biggest challenges.

Face Recognition

Built for the most challenging applications, Paravision® face recognition consistently ranks among the top global performers in NIST Face Recognition Technology Evaluations, and is easy-to-deploy across major platforms — from cloud to edge.

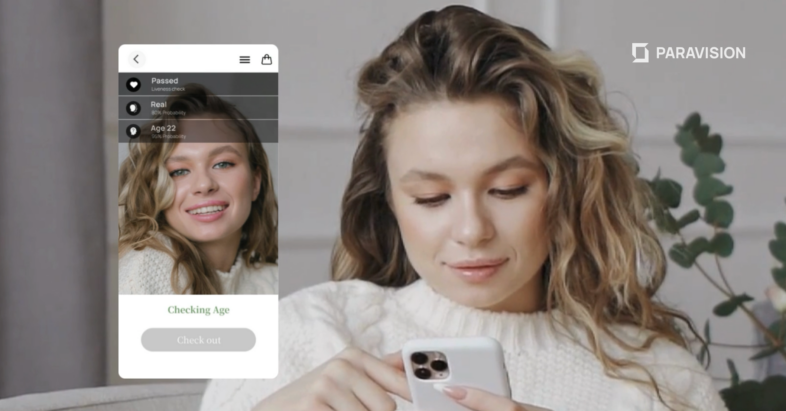

Identity+

Liveness and deepfakes, person and object detection, advanced attributes analysis. Paravision Identity+ can enhance security and identity while promoting safety and efficiency.

Vision AI

Medical imaging, logistics, and manufacturing. Paravision’s leading Vision AI Capabilities can improve outcomes for critical individual, business, and societal challenges across multiple industries.

Our Trusted Vision AI software is:

-

Accurate

Paravision products have been consistently top-ranked by leading benchmarks for accuracy at scale.

-

Responsible

Firmly rooted in our AI Principles, our software is ethically built and conscientiously sold, and we’re steadfastly committed to doing business the right way.

-

Flexible & scalable

Paravision AI software has been optimized for a range of compute environments from cloud to edge, and is offered in modular elements that can be deployed to suit operational needs.

-

US-based

Paravision is proud to be a US-based leader in Vision AI. Whether in technical partnership, working through end-user challenges, or collaborating on market strategy, we strive to be dynamic, responsive, and focused on delivering excellence.

-

Fast

Utilizing the most advanced AI frameworks and partnered with leading providers of hardware accelerators for AI and deep learning, Paravision delivers speed, scalability, and responsiveness while lowering operating costs.

-

Secure

Our SDKs and Vision AI engines can be integrated into modern, secure infrastructure. We also build advanced solutions for identity-based security threats, like spoof attempts and deepfakes.